Hi everyone! Welcome to Over and Under, a new series where we'll be picking – you guessed it – an overvalued and an undervalued card each month to evaluate. So let's get right in to it.

Ok, so I'm going to give y'all a bit of a "first-one's-free" here, because we have a lot to unpack from the overvalued section this month. I've picked these because, other than all just being overvalued as evaluated by their market prices in isolation, they are all being affected by roughly the same sales phenomenon. Each of these has popped up on the daily Interests (as well as our Premium feature, the Monthly Interests) recently, and for good reason.

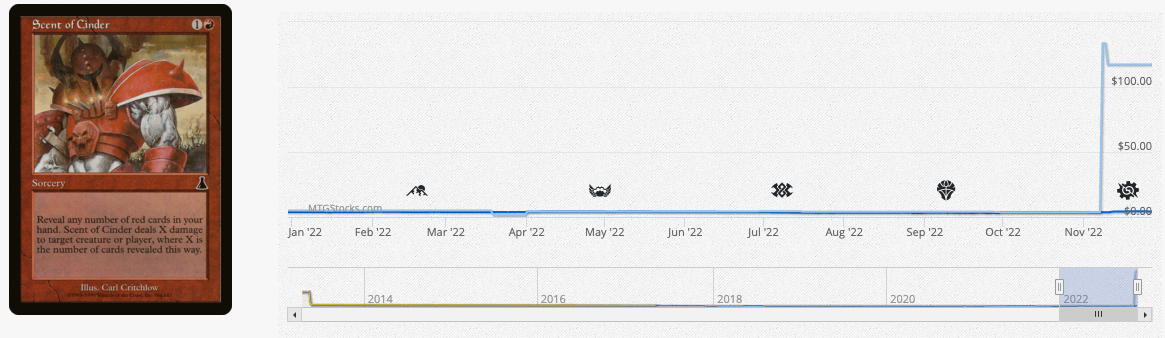

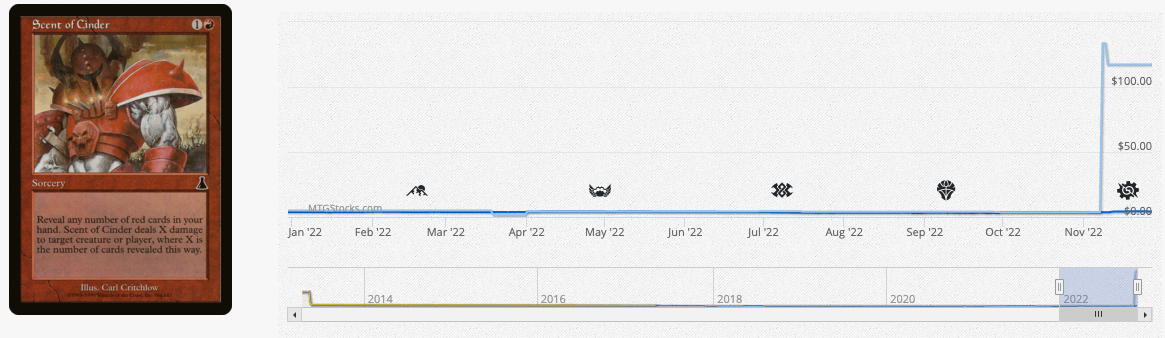

In order of most to least absurd, let's start with Scent of Cinder, specifically the Media Promo printing.

I've never heard of this card before now, much less seen it be played. This isn't even a case of speculation due to rarity. The problem here – as is the problem for the next two cards in this chunk of Over and Under – is that a couple of listings were sold at an astronomically high price and are skewing the data set which is used to calculate the market price. Scent of Cinder is a low volume mover, so a few sales can have quite a crack at its market price, which is exactly what we see here. This ability to skew a data set with a couple of high-priced purchases is directly proportional to the average number of card sales over time, which is why Scent of Cinder is the poster-child for our overvalued cards this month. Compare the market price to the median price and you can see what I mean – sales are still moving at the "normal" (i.e. median) price for the card in spite of the absurd market price. In essence, the market price right now is an echo of a trend that was never really there to begin with, so proceed with caution when dealing with this card.

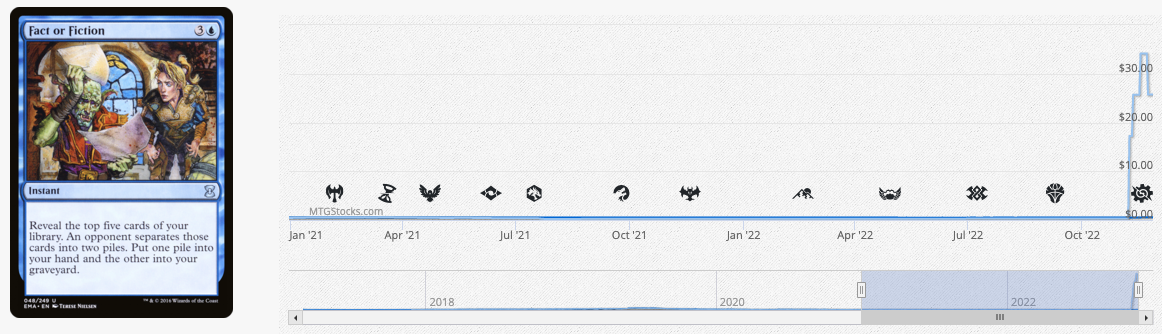

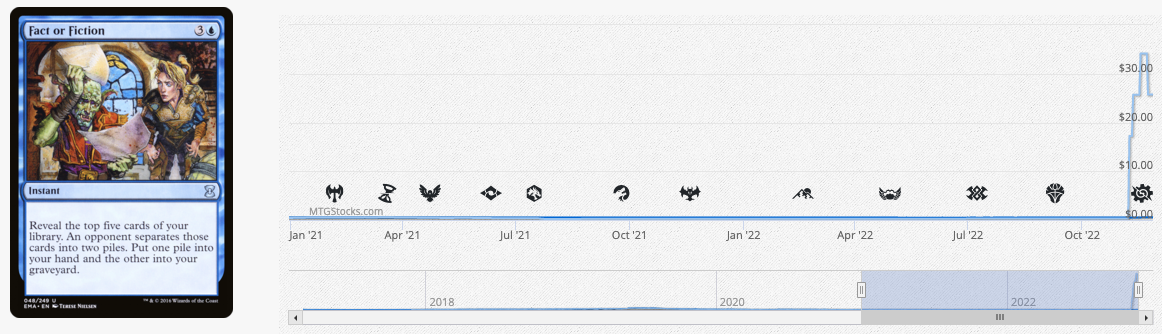

Next up, the Eternal Masters printing of Fact or Fiction.

Fact or Fiction is a higher volume mover overall, so a few high-price listings don't swing the numbers too badly, but the spike here is still substantial to say the least. The card is good, I'll definitely grant it that, but I'm not throwing $30+ at an uncommon from a modern-era reprint set, and neither is the vast majority of the market. Again, cross referencing the market and median prices here is a valuable step, as it confirms the discrepancy as one not necessarily affecting the average forward listing right now.

Finally, let's look at our last overvalued pick, the Battle for Zendikar printing of Ulamog, the Ceaseless Hunger

This is a bit of a more interesting case. Yes, the same phenomenon as before is happening here, just cross reference the sales history with the market/median price differential for a quick verification, but the price difference isn't as monumental. This is for a couple of reasons. First off, like Fact or Fiction, Ulamog is a playable card with a high sales volume, so the window for market calculations moves faster as replacement data pushes out and revalues old sales history. Secondly, the price difference between the outlier sales and the standard sale wasn't as high to begin with. Ulamog trends around the $50-$60 mark, and the outlier sales all were around $200. In terms of absolute value, this is still quite a difference, but in terms of percentages its nothing compared to what something like Scent of Cinder experienced ($4 averages with a $200 outlier is of a completely different order of magnitude). What this leaves us with is an artificially inflated market price, but not so great a spike as to shock the market to the point of ignoring it. This behaviour, when coupled with Ulamog's preexisting upwards price trend, is actually creating a slight accelerated upwards push on the price of the card. The market value is still distorted, don't get me wrong, but if I learned anything in market economics so far it's that expectations can be self-fulfilling. In short, don't touch Ulamog, the Ceaseless Hunger at prices above the TCGPlayer median, but if you have a copy or two on you that you aren't using, I'd be patient and keep an eye on if the upward pressure turns into a legitimately higher-priced marketplace with opportunity for greater sales value.

Okay, now that we're done with what to flip, let's look what could be a good pickup: our undervalued card of the month, Gemstone Caverns.

Gemstone Caverns is an interesting case. As far as game piece mechanics are concerned, it is a unique effect that fulfils a competitive niche as well as an incremental advantage slot; it's a solid but small component of multiple non-rotating format lists, as well as a staple across cEDH. In short, demand for the card is relatively stable and, if anything, has a future with a likelihood of rising demand. Pricewise, the card is certainly on a cyclical uptrend – periodic spikes of interest followed by rubber band-esque collapses back to a slightly above pre-spike price – but what's really interesting about this is that the price trend is on the upwards swing in spite of reprints as well as the overall downwards pressure of a bearish market.

This sounds great and all, but what takes it from being a value pick and moves it to being something with a greater potential for a price increase?

Well, let's look back at the price history, because to get a better sense for this question we are going to need some price projections and a broader approach to market sentiment. Additionally, from here on out I'm going to write with the massive asterisk that this card is probably going to be reprinted at some point, so while I will reiterate that I think this card is undervalued, there will likely be a point when it can be bought for cheaper (just ask it's Time Spiral Remastered cousin, Tarmogoyf). The question is, however, will that price be cheaper than the market price now, or just cheaper than its next spike?

Returning to that cyclical uptrend notion from before, it's important to put some context behind it. Magic cards frequently undergo one of two principal price directions when they are reprinted – they either decrease and stay suppressed because of a market supply flood which outpaces demand, or they decrease briefly and then gradually trend upwards as the new eyes brought to the market begin to outnumber the new copies available. Reprints and releases bring market noise and new demand from players who previously couldn't access the card, and sometimes this new demand supports a price spike after a reprint, counter to the standardly intuitive price suppression new supply would otherwise bring. Gemstone Caverns hit the sweet spot of being reprinted in very limited quantities (The List is barely a dent in the market, and Time Spiral: Remastered flew off shells before most players could get their hands on it) whilst occupying a growing competitive niche due to its unique effect, one which it holds to this day. In essence, the reprints Gemstone Caverns has experienced have been flashes in the pan – enough to dazzle and interest an audience into considering picking up a copy, but not enough to suppress the price long term.

Looking back at the data, Gemstone Caverns has passed its most recent contraction and is back on the upswing. It is in the gradual uptrend portion of its cyclical upward swing; all the while being held down by a broader market bearishness. In essence, while it may not be the most heavily discounted card on the market, all the factors which can support the price of a non-reserved list card are there for Gemstone Caverns, and it doesn't look like it will be falling any time soon.